Life Insurance Myths That Most People Still Believe

Life Insurance Myths That Most People Still Believe

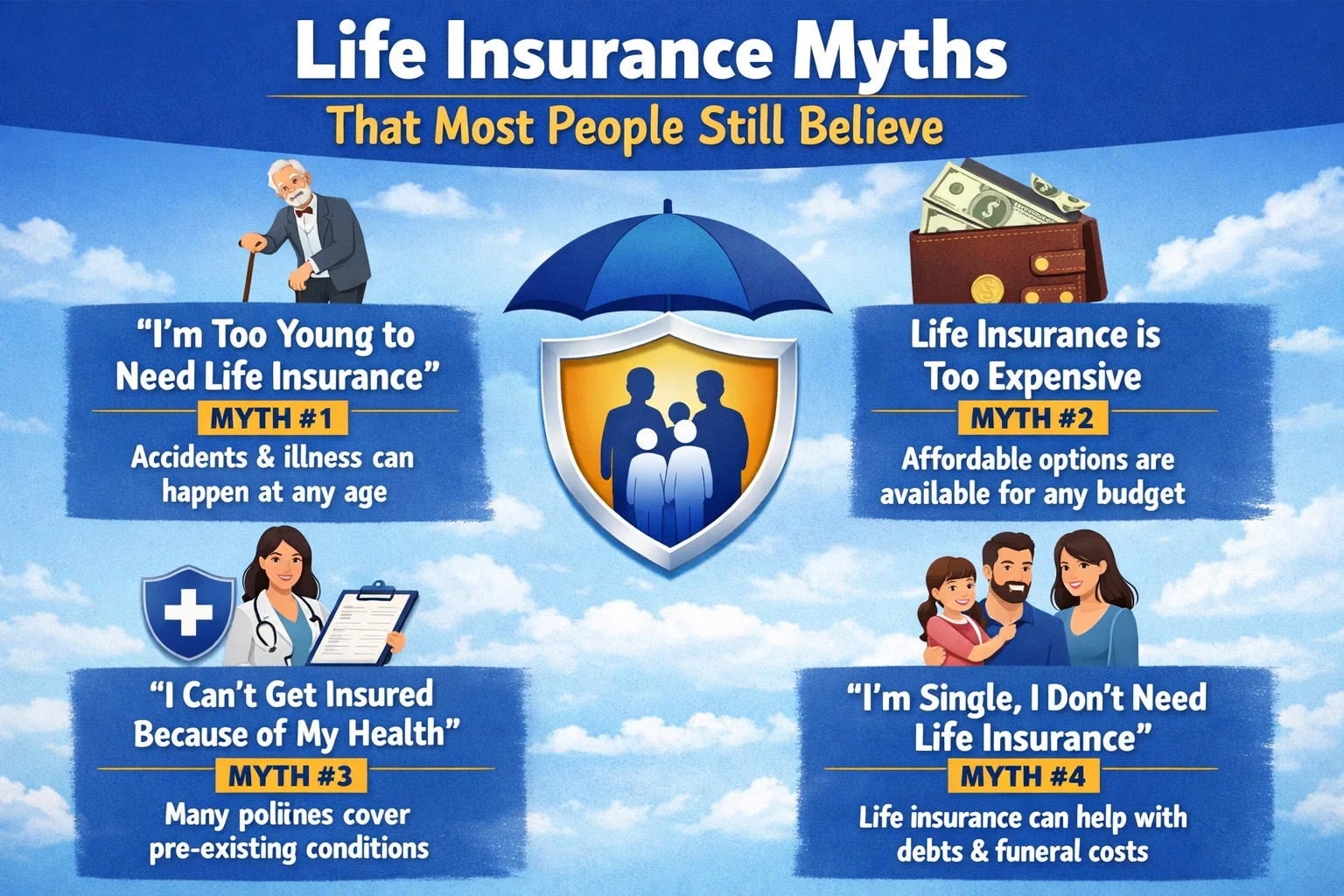

Despite being one of the most important financial tools, life insurance remains widely misunderstood. Across Tier-1 countries like the United States, Canada, the United Kingdom, and Australia, millions of people delay or completely avoid buying life insurance due to persistent myths.

These misconceptions often lead to underinsurance, financial stress for families, and missed opportunities for long-term wealth protection. In this guide, we break down the most common life insurance myths and replace them with real, data-backed facts.

Why Life Insurance Myths Are So Dangerous

Life insurance myths don’t just cause confusion — they create financial risk. Believing incorrect information can result in:

- Insufficient coverage amounts

- Overpaying for policies

- Delaying protection until it becomes expensive

- Leaving dependents financially vulnerable

Understanding the truth allows you to make confident, cost-effective insurance decisions.

Myth #1: Life Insurance Is Only for Older People

This is one of the most common and damaging myths. In reality, life insurance is most affordable when you are young and healthy.

Premiums increase with age, health risks, and lifestyle factors. Buying early locks in lower rates for decades, especially with term life insurance.

Fact: Young professionals, newly married couples, and new parents benefit the most from early coverage.

Myth #2: Life Insurance Is Too Expensive

Many people overestimate the cost of life insurance by 3–5 times. In Tier-1 countries, term life insurance can cost less than a daily coffee.

| Age | Coverage Amount | Estimated Monthly Cost |

|---|---|---|

| 30 | $500,000 | $20–$30 |

| 40 | $500,000 | $35–$50 |

| 50 | $500,000 | $70–$100 |

Fact: Life insurance is one of the most cost-effective financial protections available.

Myth #3: Employer Life Insurance Is Enough

Employer-provided life insurance is often limited to 1–2 times annual salary. For most families, this amount is far from sufficient.

Additionally, employer coverage ends when you change jobs, retire, or are laid off.

Fact: Personal life insurance ensures continuous protection regardless of employment status.

Myth #4: Stay-At-Home Parents Don’t Need Life Insurance

Non-working spouses provide immense economic value through childcare, household management, and emotional support.

If something happens, replacing these services can cost tens of thousands annually.

Fact: Stay-at-home parents absolutely need life insurance coverage.

Myth #5: Single People Don’t Need Life Insurance

Even single individuals may have:

- Student loans with co-signers

- Aging parents

- Business partners

- Estate planning goals

Fact: Life insurance protects financial responsibilities beyond spouses and children.

Myth #6: Life Insurance Only Pays After Death

Permanent life insurance policies offer living benefits such as:

- Cash value accumulation

- Policy loans

- Tax-advantaged savings

- Retirement income strategies

Fact: Life insurance can support you financially during your lifetime.

Myth #7: Term Life Insurance Is a Waste of Money

Some believe term life insurance is wasted because it expires. This ignores its primary purpose — affordable, high-value protection during critical life stages.

Fact: Term life insurance offers maximum coverage at the lowest cost.

Myth #8: Whole Life Insurance Is Always a Bad Investment

Whole life insurance is not designed to replace market investments but to complement them.

It provides:

- Guaranteed death benefits

- Tax-deferred growth

- Predictable returns

- Estate planning advantages

Fact: Whole life insurance works best for long-term wealth and estate strategies.

Myth #9: Only Breadwinners Need Life Insurance

Every contributing family member has economic value, whether through income or services.

Fact: Life insurance should be part of a household-wide financial plan.

Myth #10: Life Insurance Claims Are Hard to Get Paid

Major insurance providers in Tier-1 countries maintain claim settlement ratios above 95%.

Claims are usually delayed only due to incorrect documentation or non-disclosure.

Fact: Legitimate claims are paid quickly and reliably.

Why These Myths Persist

- Lack of financial education

- Complex terminology

- Outdated advice

- Fear-based marketing

How to Make Smart Life Insurance Decisions

- Assess long-term financial responsibilities

- Compare term and permanent options

- Buy coverage early

- Review policies regularly

Final Thoughts: Truth Beats Myths Every Time

Life insurance myths can cost families years of financial security. The truth is simple: life insurance is affordable, flexible, and essential for long-term financial planning.

By understanding the real facts, you empower yourself to protect your loved ones, preserve wealth, and build a future with confidence.

Smart financial planning begins with informed decisions — and life insurance is one of the smartest decisions you can make.

Comments (3)