How to Compare Insurance Policies Like a Pro

How to Compare Insurance Policies Like a Pro

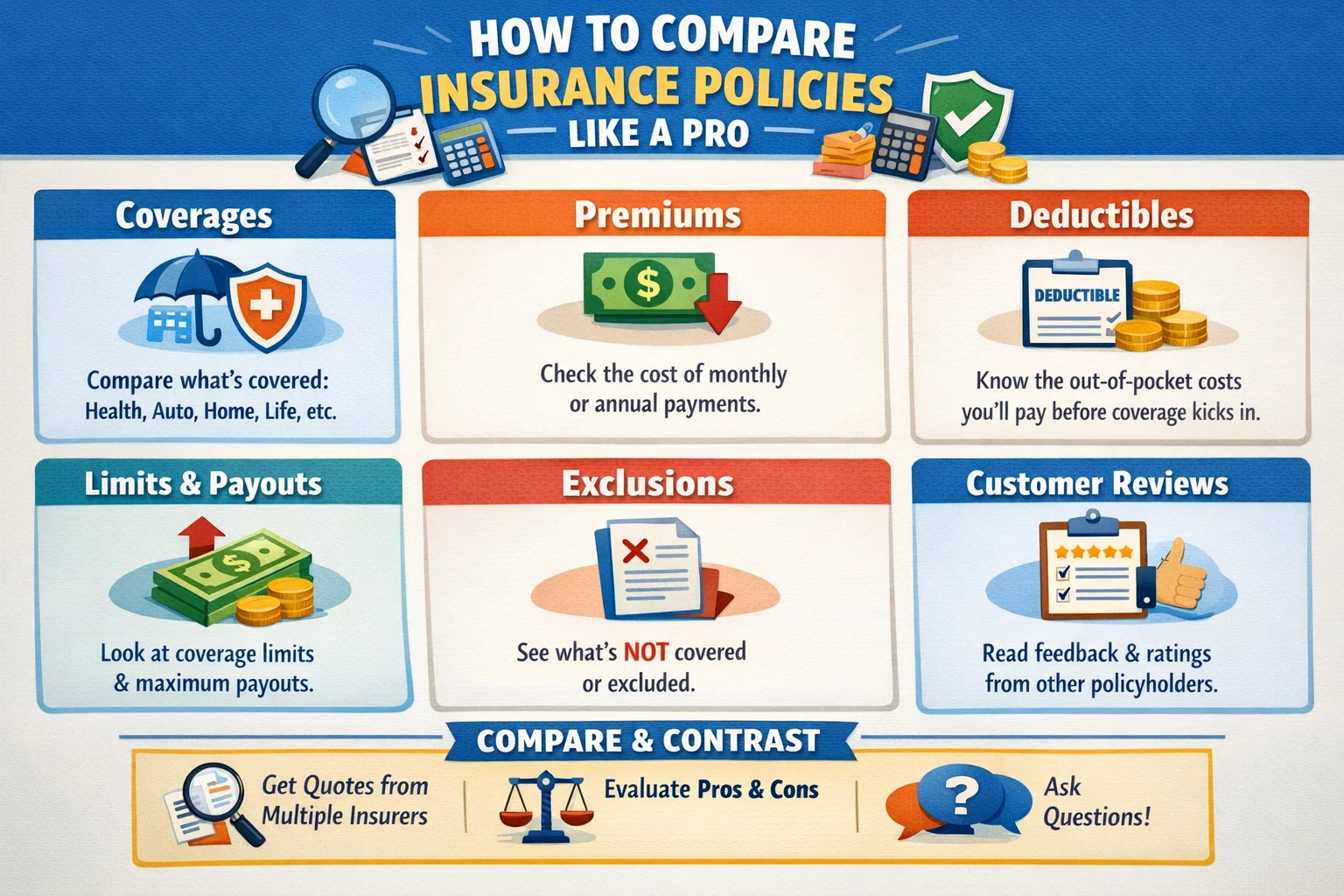

Choosing the right insurance policy is one of the most important financial decisions you will ever make. Whether it’s life insurance, health insurance, car insurance, or travel insurance, making the wrong choice can cost you thousands of dollars in premiums, uncovered claims, or financial stress during emergencies. Learning how to compare insurance policies like a pro helps you secure the best coverage at the right price—especially in high-cost Tier 1 countries such as the USA, UK, Canada, and Australia.

In this in-depth guide, we’ll break down a professional, step-by-step framework to compare insurance policies effectively. You’ll learn how experts evaluate coverage, premiums, exclusions, claim settlement ratios, and long-term value—so you can confidently choose the best insurance policy for your needs.

Why Comparing Insurance Policies Is So Important

Many people buy insurance based on brand name, agent recommendations, or price alone. This approach often leads to underinsurance or overpaying for benefits you don’t need.

Proper insurance comparison helps you:

- Get maximum coverage for your money

- Avoid hidden exclusions and claim rejections

- Choose policies with higher claim approval rates

- Optimize long-term financial protection

Step 1: Clearly Define Your Insurance Needs

Before comparing insurance policies, you must understand what you actually need. Different individuals and families have different risk profiles.

Questions to Ask Yourself

- What type of insurance do I need? (Life, Health, Car, Travel)

- How much coverage is sufficient for my situation?

- Who depends on me financially?

- Which risks would cause the biggest financial loss?

Without clear requirements, comparing policies becomes confusing and ineffective.

Step 2: Compare Coverage, Not Just Premium

One of the biggest mistakes people make is comparing insurance policies only on price. A lower premium often means reduced coverage, higher deductibles, or strict exclusions.

| Comparison Factor | Low-Premium Policy | Comprehensive Policy |

|---|---|---|

| Coverage Amount | Limited | High & Adequate |

| Exclusions | Many | Minimal |

| Claim Approval | Lower | Higher |

| Long-Term Value | Poor | Excellent |

Always prioritize coverage quality over just saving a few dollars on premium.

Step 3: Evaluate Policy Inclusions Carefully

Policy inclusions define what is actually covered. Two policies with the same sum insured can offer very different benefits.

Key Inclusions to Check

- Medical coverage and hospitalization limits

- Emergency services and evacuation

- Accidental death or disability benefits

- Cashless treatment network

- Worldwide or Tier 1 country coverage

Professional policy comparison always focuses on inclusions first.

Step 4: Understand Policy Exclusions in Detail

Exclusions are conditions or situations where the insurer will not pay a claim. Ignoring exclusions is one of the most expensive mistakes policyholders make.

Common Insurance Exclusions

- Pre-existing medical conditions

- Self-inflicted injuries

- Alcohol or substance abuse

- High-risk activities

- War or civil unrest

Always compare exclusions side-by-side to avoid unpleasant surprises.

Step 5: Compare Deductibles and Co-Payments

Deductibles and co-payments directly affect how much you pay out of pocket during a claim.

A policy with a lower premium but higher deductible may cost you more during emergencies.

Professionals balance premium affordability with reasonable deductibles.

Step 6: Check Claim Settlement Ratio and Insurer Reputation

The claim settlement ratio (CSR) shows how many claims an insurer successfully pays. A higher ratio generally indicates better reliability.

- Look for insurers with consistently high CSR

- Check customer reviews and complaint records

- Prefer insurers with strong global presence

For high-value insurance markets like the USA and Europe, insurer credibility is critical.

Step 7: Compare Add-Ons and Riders

Add-ons and riders enhance your base policy and often provide the highest value for money.

Popular High-Value Add-Ons

- Critical illness rider

- Accidental death benefit

- Waiver of premium

- Zero depreciation (for car insurance)

- Pre-existing disease cover

Compare both availability and pricing of riders across insurers.

Step 8: Analyze Policy Terms and Conditions

Policy wording contains crucial details that define how claims are processed. Professionals always read the fine print.

- Waiting periods

- Renewal conditions

- Grace periods

- Portability options

Step 9: Compare Long-Term Costs, Not Just First-Year Premium

Many policies increase premiums significantly over time. Comparing only the first-year premium is misleading.

Evaluate projected premiums over 5, 10, or 20 years—especially for life and health insurance.

Step 10: Use Online Insurance Comparison Tools Wisely

Online comparison platforms can save time, but they often highlight sponsored or commission-heavy plans.

Use them as a starting point—not the final decision-making tool.

Common Mistakes to Avoid While Comparing Insurance Policies

- Choosing the cheapest policy blindly

- Ignoring exclusions and deductibles

- Overlooking claim settlement history

- Not considering future needs

- Relying only on agent recommendations

Pro Tips to Compare Insurance Policies Like an Expert

- Always compare at least 3–5 policies

- Match coverage to real-life risks

- Prefer transparency over brand hype

- Choose flexibility and upgrade options

- Review policy annually

Why Smart Insurance Comparison Saves You Money

Proper insurance comparison not only saves premium costs but also protects you from massive out-of-pocket expenses during emergencies. In Tier 1 countries, where healthcare and liability costs are extremely high, choosing the right policy can be the difference between financial stability and long-term debt.

Final Thoughts

Learning how to compare insurance policies like a pro empowers you to make smarter, safer, and more profitable financial decisions. By focusing on coverage, exclusions, claim reliability, and long-term value, you can confidently choose an insurance policy that truly protects you and your loved ones.

Remember: the best insurance policy is not the cheapest one—it’s the one that pays when you need it the most.

Comments (3)