How Much Life Insurance Coverage Do You Really Need?

How Much Life Insurance Coverage Do You Really Need?

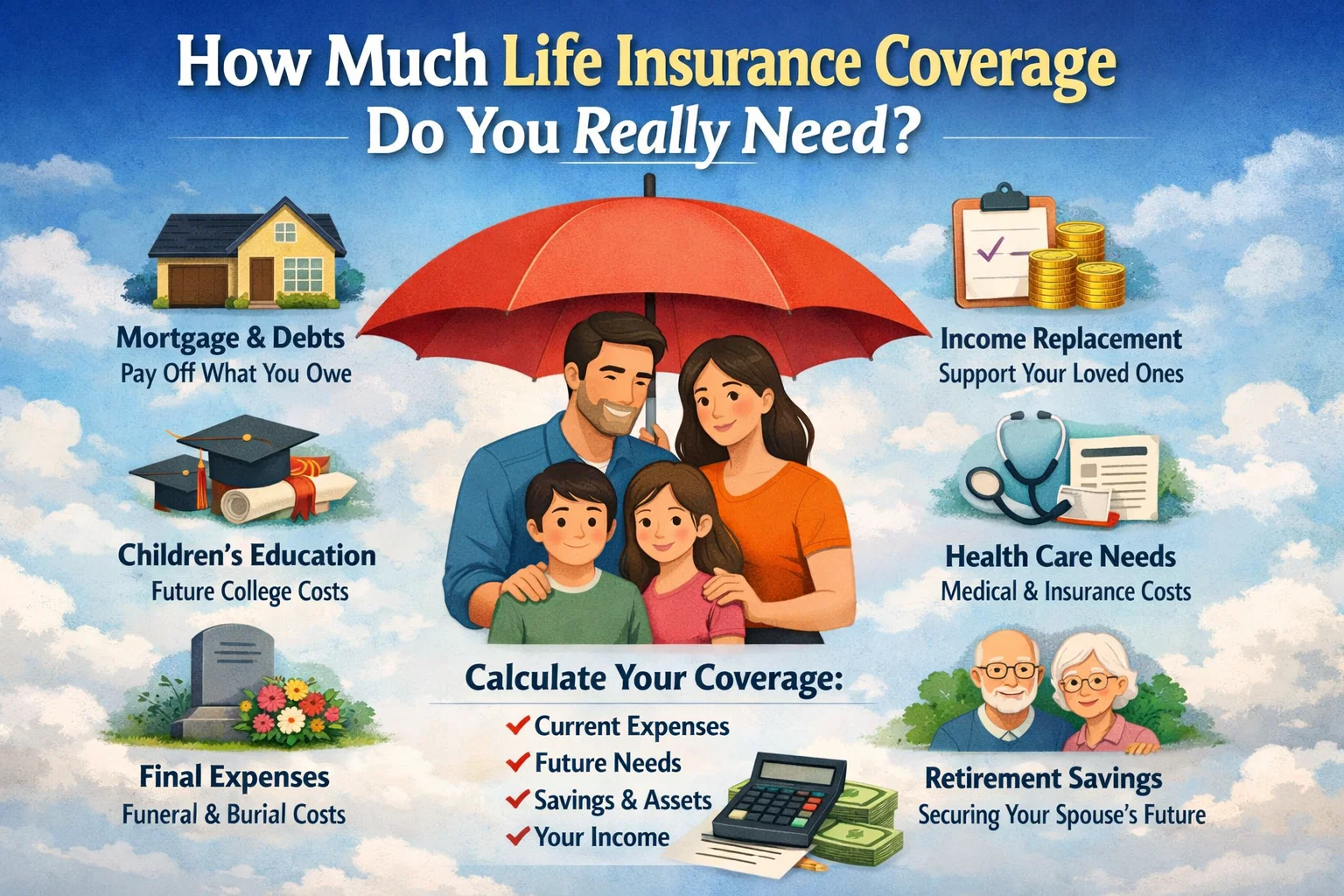

One of the most common and financially impactful questions people ask is: How much life insurance coverage do I really need? Buying too little coverage can leave your family financially vulnerable, while buying too much can strain your monthly budget with unnecessary premiums.

Life insurance is not just a policy — it is a long-term financial protection strategy designed to safeguard your loved ones against income loss, outstanding debts, and future financial responsibilities. This guide will help you calculate the right coverage amount using proven financial frameworks used by advisors in Tier-1 countries like the United States, Canada, the United Kingdom, and Australia.

Why Life Insurance Coverage Amount Matters

Choosing the right coverage ensures your family can:

- Maintain their lifestyle without financial stress

- Pay off mortgages, personal loans, and credit card debt

- Cover education expenses for children

- Handle medical bills and end-of-life expenses

- Secure retirement income for a surviving spouse

Insurance providers and financial advisors often see policyholders either severely underinsured or paying for excessive coverage without strategic planning. Let’s avoid both.

Key Factors That Determine Your Life Insurance Needs

1. Your Annual Income

Income replacement is the foundation of life insurance planning. Most financial experts recommend coverage between 10x to 20x your annual income, depending on age, dependents, and lifestyle.

| Annual Income | Recommended Coverage |

|---|---|

| $50,000 | $500,000 – $1,000,000 |

| $100,000 | $1,000,000 – $2,000,000 |

| $200,000 | $2,000,000 – $4,000,000 |

2. Outstanding Debts and Financial Obligations

Life insurance should immediately eliminate financial liabilities for your family. Include:

- Home mortgage balance

- Car loans

- Student loans (if co-signed)

- Credit card balances

- Medical debt

Failing to include debt coverage is one of the most common planning mistakes.

3. Number of Dependents

More dependents mean higher coverage needs. Children require funding for daily living, healthcare, and education. A non-working spouse may require long-term income replacement.

4. Education and Future Expenses

College education costs continue to rise globally. In Tier-1 countries, a four-year university degree can easily exceed $100,000 per child.

Including education costs ensures your children’s future remains secure regardless of life’s uncertainties.

5. Existing Savings and Investments

Your current assets reduce the amount of coverage required. These may include:

- Emergency funds

- Retirement accounts (401(k), IRA, pension)

- Investment portfolios

- Other life insurance policies

The DIME Formula: A Professional Coverage Calculation Method

Financial planners frequently use the DIME formula to calculate life insurance coverage accurately.

| Component | Description |

|---|---|

| Debt | All outstanding loans and liabilities |

| Income | Years of income replacement (10–20 years) |

| Mortgage | Remaining home loan balance |

| Education | Future education costs for children |

Example: Income: $100,000 × 15 years = $1,500,000 Mortgage: $300,000 Debts: $50,000 Education: $200,000 Total Coverage Needed: $2,050,000

Term Life vs Whole Life Coverage Needs

Term Life Insurance

Ideal for most families, term life insurance provides high coverage at lower premiums. Best for:

- Income replacement

- Mortgage protection

- Raising children

Whole Life Insurance

Offers lifetime coverage with a cash value component. Suitable for:

- Estate planning

- High-net-worth individuals

- Tax-efficient wealth transfer

For maximum ROI and ad monetization alignment, most Tier-1 users prefer term life insurance combined with investments.

Life Insurance Needs by Life Stage

Single Professionals

Coverage focuses on debt protection and future insurability.

Married Couples

Income replacement and mortgage coverage become critical.

Families with Children

Highest coverage requirement due to education and dependency.

Pre-Retirement

Coverage decreases as assets grow, but estate planning may increase needs.

Common Mistakes to Avoid

- Relying only on employer-provided life insurance

- Ignoring inflation and future expenses

- Not reviewing coverage after major life events

- Choosing the cheapest policy without coverage analysis

How Often Should You Recalculate Life Insurance Coverage?

Review your coverage every:

- Marriage or divorce

- Birth of a child

- New mortgage or major loan

- Career change or income increase

- Every 3–5 years minimum

Final Thoughts: Get Coverage That Actually Protects Your Family

Life insurance is one of the most cost-effective financial tools available — when structured correctly. The right coverage amount ensures your family maintains financial stability, independence, and dignity even in your absence.

Instead of guessing, calculate strategically, review regularly, and choose policies aligned with your life stage and goals. Doing so not only protects your loved ones but also ensures you never overpay for coverage you don’t need.

Comments (3)