Car Insurance Explained: Coverage Types and Benefits

Car Insurance Explained: Coverage Types and Benefits

Car insurance is more than a legal requirement—it is a critical financial safety net. In Tier-1 countries like the United States, Canada, the United Kingdom, and Australia, auto insurance protects drivers from massive out-of-pocket expenses caused by accidents, theft, natural disasters, and liability claims.

This in-depth guide explains car insurance in simple terms, explores all major coverage types, and helps you understand how to choose the right policy for maximum financial protection in 2026.

What Is Car Insurance?

Car insurance (also known as auto or vehicle insurance) is a contract between you and an insurance company. You pay a premium, and the insurer agrees to cover financial losses related to your vehicle based on the coverage you choose.

Car insurance typically covers:

- Vehicle damage

- Third-party property damage

- Medical expenses

- Legal liability

- Theft and natural disasters

Why Car Insurance Is Mandatory in Most Countries

Governments require car insurance to ensure that accident victims receive compensation without lengthy legal disputes. Without insurance, even a minor accident could lead to severe financial hardship.

Mandatory insurance protects:

- Drivers

- Passengers

- Pedestrians

- Public and private property

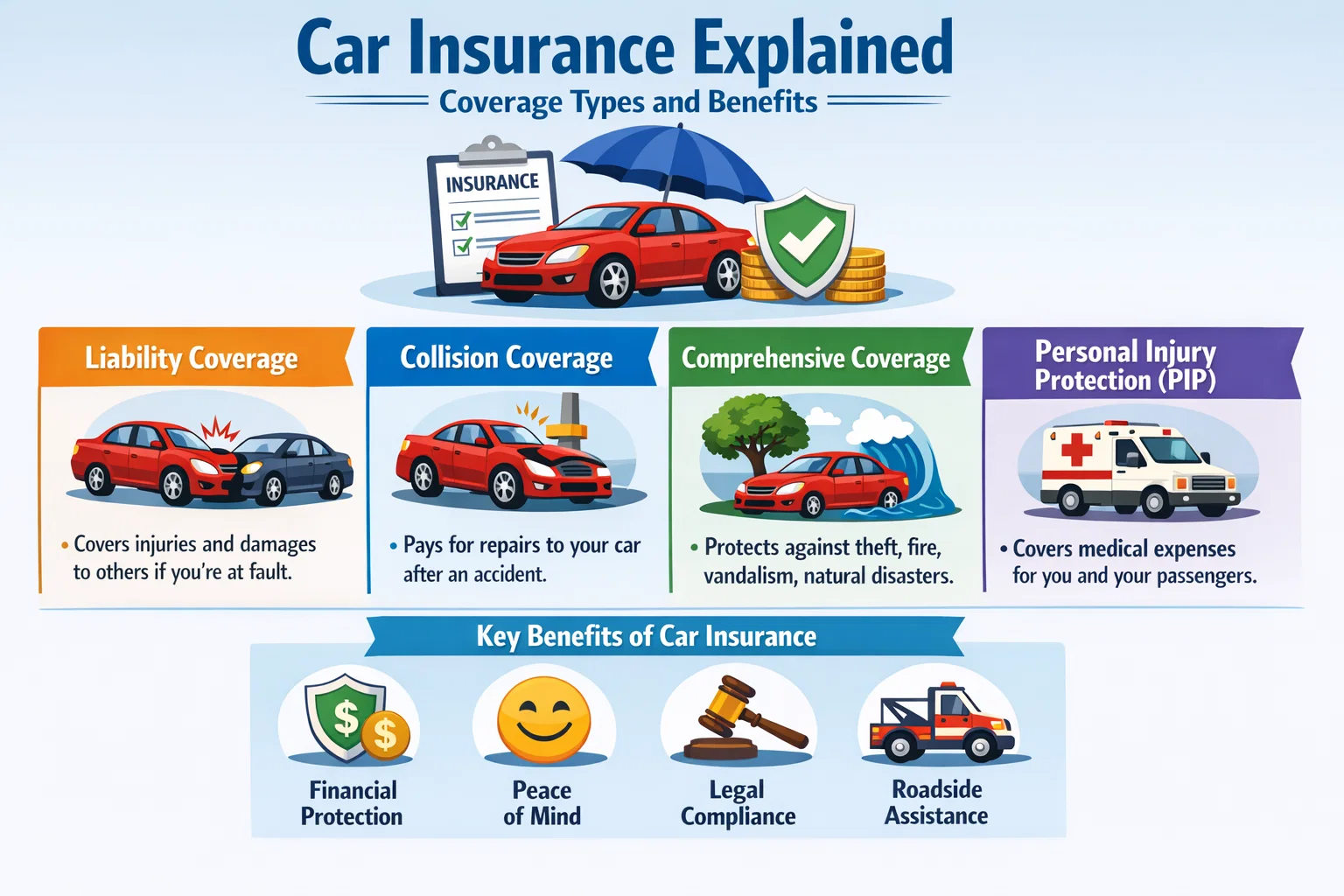

Main Types of Car Insurance Coverage

Understanding coverage types is essential to avoid underinsurance or overpaying.

1. Liability Insurance

Liability insurance is the foundation of most auto insurance policies and is legally required in many Tier-1 countries.

It covers:

- Bodily injury to others

- Damage to third-party property

- Legal defense costs

Important: Liability insurance does NOT cover your own vehicle damage.

2. Collision Insurance

Collision coverage pays for repairs or replacement of your vehicle after an accident, regardless of who is at fault.

This coverage is especially important for:

- New cars

- Financed or leased vehicles

- High-value vehicles

3. Comprehensive Insurance

Comprehensive insurance covers non-collision incidents such as:

- Theft

- Fire

- Floods and storms

- Vandalism

- Animal damage

This coverage is essential in regions prone to extreme weather.

Optional but High-Value Car Insurance Add-Ons

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers, regardless of fault.

Uninsured / Underinsured Motorist Coverage

Protects you if the at-fault driver has insufficient or no insurance.

Roadside Assistance

Covers towing, battery jump-starts, flat tires, and emergency fuel delivery.

Rental Car Reimbursement

Pays for a rental vehicle while your car is being repaired.

Comparison of Major Car Insurance Coverage Types

| Coverage Type | What It Covers | Mandatory |

|---|---|---|

| Liability | Injury & property damage to others | Yes |

| Collision | Your car after an accident | No |

| Comprehensive | Theft, fire, natural disasters | No |

| PIP | Medical expenses | Depends on region |

Benefits of Car Insurance

- Financial protection against large repair costs

- Legal compliance

- Medical expense coverage

- Peace of mind while driving

- Protection against uninsured drivers

What Affects Car Insurance Premiums?

Premiums are calculated using risk-based factors:

- Age and driving experience

- Driving history

- Vehicle type and value

- Location

- Annual mileage

- Coverage limits and deductibles

Safe drivers with clean records receive the lowest premiums.

How to Choose the Right Car Insurance Policy

- Assess your vehicle value

- Understand legal requirements

- Choose adequate liability limits

- Add comprehensive coverage if needed

- Compare insurers and claim settlement ratios

Common Car Insurance Mistakes to Avoid

- Choosing minimum coverage only

- Ignoring uninsured motorist coverage

- Not reviewing policy annually

- Hiding driving history

Car Insurance in 2026: What’s New?

Modern car insurance now includes:

- Usage-based insurance (UBI)

- Telematics and AI pricing

- Digital claims processing

- EV-specific coverage

These innovations improve pricing accuracy and customer experience.

Final Thoughts

Car insurance is not just a regulatory requirement—it is a powerful financial shield. Choosing the right coverage protects your assets, your income, and your peace of mind.

By understanding coverage types and benefits, you can confidently select a policy that meets your needs while avoiding unnecessary risks and expenses.

Smart drivers don’t just drive safely—they insure wisely.

Comments (3)