Top Reasons Why Insurance Claims Get Rejected

Top Reasons Why Insurance Claims Get Rejected

Filing an insurance claim can be stressful, especially when it gets rejected. Across Tier-1 countries like the United States, United Kingdom, Canada, and Australia, thousands of insurance claims are denied every year due to avoidable mistakes. Understanding the top reasons why insurance claims get rejected can save you time, money, and frustration.

This in-depth guide explains the most common insurance claim rejection reasons, real-world examples, and expert strategies to ensure your claim gets approved smoothly. Whether it’s health, car, home, travel, or life insurance, the principles remain largely the same.

What Does Insurance Claim Rejection Mean?

An insurance claim rejection occurs when an insurer refuses to pay part or all of the claimed amount. This usually happens when the claim does not comply with policy terms, documentation requirements, or regulatory guidelines.

Claim rejection doesn’t always mean wrongdoing—it often results from misunderstanding policy details or procedural errors.

Why Insurance Companies Reject Claims

Insurance companies evaluate claims based on risk, policy wording, and legal compliance. Even minor deviations can trigger a rejection.

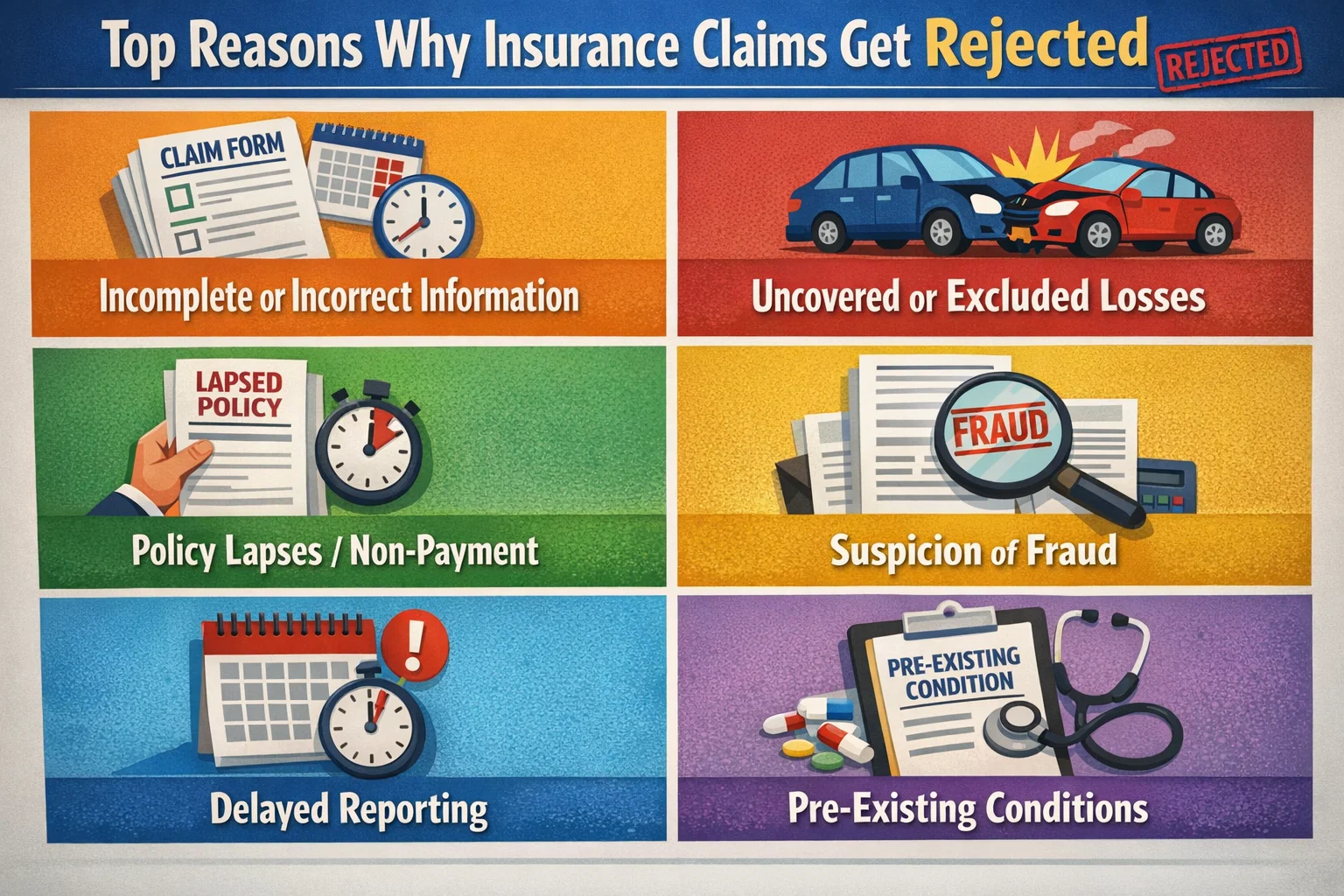

Top Reasons Why Insurance Claims Get Rejected

1. Non-Disclosure or Misrepresentation

One of the most common reasons for insurance claim rejection is non-disclosure of important information at the time of buying the policy.

- Not declaring pre-existing medical conditions

- Incorrect vehicle usage details

- False income or occupation information

Insurers verify facts during claim assessment, and inconsistencies can lead to immediate rejection.

2. Policy Exclusions

Every insurance policy has exclusions—events or situations that are not covered.

- Cosmetic procedures in health insurance

- Wear and tear in car insurance

- Extreme sports in travel insurance

Filing a claim for an excluded event almost always results in rejection.

3. Policy Lapse or Expiry

Claims made when the policy has expired or lapsed due to non-payment of premiums are automatically rejected.

In Tier-1 markets, insurers rarely provide grace exceptions for expired policies.

4. Delay in Claim Intimation

Most insurance policies require claims to be reported within a specific time frame.

- Car accidents: usually within 24–48 hours

- Health insurance: within hospitalization window

- Travel insurance: immediately after incident

Late notification raises suspicion and can lead to rejection.

5. Incomplete or Incorrect Documentation

Missing documents are a major cause of claim delays and denials.

| Insurance Type | Common Missing Documents |

|---|---|

| Health Insurance | Discharge summary, medical bills |

| Car Insurance | Police report, repair estimate |

| Home Insurance | Damage photos, ownership proof |

| Travel Insurance | Delay certificates, tickets |

6. Claim Amount Exceeds Coverage Limit

Insurance policies have predefined coverage limits. Claims exceeding these limits are either partially approved or rejected.

This is especially common in:

- Health insurance room rent caps

- Travel insurance medical limits

- Home insurance underinsured assets

7. Not Following Claim Procedure

Many claims fail simply because policyholders don’t follow the correct procedure.

- Using non-network hospitals

- Repairing vehicles before inspection

- Not getting prior approvals

8. Fraud or Suspicious Activity

Any indication of fraud—fake bills, inflated amounts, staged accidents—results in immediate rejection and possible blacklisting.

Insurers in Tier-1 countries use advanced AI-based fraud detection systems.

9. Waiting Period Not Completed

Many insurance policies have waiting periods, especially health and life insurance.

Claims made during the waiting period are commonly rejected.

10. Claim Filed for Non-Covered Person or Asset

Claims are rejected when:

- The insured person is not listed

- The asset is not registered under the policy

- Unauthorized drivers are involved

How to Avoid Insurance Claim Rejection

- Read policy documents thoroughly

- Disclose all material facts honestly

- Maintain updated documentation

- Report incidents immediately

- Follow insurer-approved procedures

What to Do If Your Insurance Claim Is Rejected

If your insurance claim gets rejected:

- Request a written rejection explanation

- Check if re-submission is possible

- File an appeal with additional proof

- Contact insurance ombudsman

- Consult legal experts for high-value claims

Claim Rejection vs Claim Settlement Delay

Not all delays mean rejection. Sometimes insurers request additional verification. Understanding the difference helps avoid unnecessary panic.

Final Thoughts: Preventing Insurance Claim Rejection

Insurance claim rejection is often preventable. The key lies in understanding your policy, being honest, and following the correct process. With rising claim scrutiny in Tier-1 countries, policyholders must be proactive and informed.

By avoiding these common insurance claim mistakes, you significantly improve your chances of fast approval and full settlement—ensuring your insurance truly protects you when it matters most.

Comments (3)